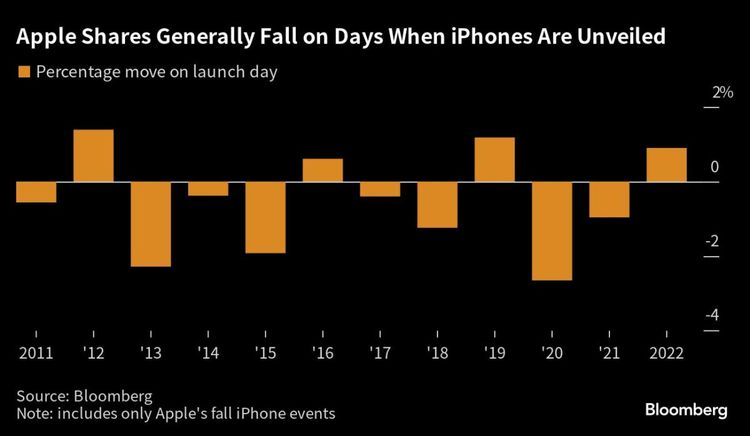

Apple’s iPhone Reveals Are Often a Dip Buyer’s Dream

Whenever Apple Inc. releases a new iPhone, the stock tends to take a hit immediately after. However, investors may want to consider waiting a few weeks as it can create a good opportunity to buy low.

Popular Articles on Bloomberg

Trudeau is currently in a difficult situation in India with a malfunctioning airplane after receiving negative feedback from Modi.

Investors are predicting that the powerful American consumer will soon encounter a difficult time.

The upcoming Apple iPhone 15 event is set to showcase a better camera, along with a new titanium finish.

Guyana currently holds the title for the most rapidly growing economy in the world, and is expected to experience a 38% expansion in the fiscal year.

For the first time on launch day, Apple will be selling iPhones that are made in India.

For the last five years, Apple seems to have trouble with September as it experiences a negative trend of 4.5% in shares. This is higher compared to the decline of 3.2% for the S&P 500 during the same period. However, October seems to be a good month for Apple, having an average gain of 3.8% over the five-year period.

According to Gene Munster, the co-founder and managing partner of Deepwater Asset Management, if you've been holding onto this company for a while and you believe it will become an essential consumer goods company, these dips in the stock market are chances to take advantage of.

Typically, the stock price of Apple rises prior to the event. However, this year things have been tough. In August, Apple's stocks plummeted following an unsatisfactory earnings report. The downward trend has persisted into the current month due to worries about China's governmental limitations on iPhones - which is Apple's primary international market. As a result, Apple's market value has dropped by nearly $300 billion since July 31st's record close.

According to Jason Benowitz, who is a senior portfolio manager at CI Roosevelt Private Wealth, the worries about China and the cycle of iPhone events have given a good opportunity to invest.

He stated that Apple is crucial for providing job opportunities and economic benefits to both the United States and China. Despite the recent rumors in the media, these essential truths remain unaltered, and it is anticipated that Apple will continue to thrive in China for a prolonged period of time.

Discover More: Apple Set to Reveal New iPhones Featuring Upgraded Cameras and Durable Titanium Coating

The upcoming Apple event is taking place on Tuesday at 10 a.m. in California. During the event, they're going to reveal the new iPhone 15 range, as well as updated watches and AirPods. Based on reports from Bloomberg News, there will be two models of the iPhone that are lower priced and two models that are more expensive.

It's no secret that Apple is struggling to maintain its position as a top-performing megacap stock. However, it's not the only one facing challenges. The Nasdaq 100 Stock Index has also taken a hit, dropping by over 2% since July due to increased Treasury yields and indications that the Federal Reserve is planning to keep interest rates up for an extended period. Other notable companies, such as Tesla Inc. and Microsoft Inc., have also suffered losses of more than 5% since their peak on July 18. Even leading chipmaker Nvidia Corp. is down by 4.9%.

Even though Apple's stocks have decreased, they still maintained a 38% increase this year. The stocks are valued at 27 times the anticipated earnings, which is a decrease from the peak of 30 times back in July. However, it's still higher than the average of 18 times over the last ten years.

Apple is looking for a way to improve their financial situation, as they have experienced a decrease in revenue for the past three consecutive quarters. Based on information collected by Bloomberg, analysts predict that the company's overall revenue will go up in the year 2024, following a drop of about 2.9% this year. This positive change will be partially due to the fact that Apple will be increasing the prices of their most expensive products, as stated by senior equity analyst at CFRA Research, Angelo Zino. This is expected to have a positive effect on the stock market.

Ken Mahoney, the CEO of Mahoney Asset Management, expressed optimism that the recent performance has paved the way for a potential rally in October and for the rest of the year.

In my opinion, we need to make it past September, which has been quite turbulent thus far," he remarked. "I am a firm believer in Apple's stock, let's be clear about that.

Today's featured technology chart Every day, we feature a different chart related to technology. The selected chart provides valuable insights into the world of technology and helps us understand various technological advancements taking place around us. Get ready to explore the latest trends and innovations in the tech sphere through our daily tech chart feature.

On Tuesday, Oracle Corp. experienced a significant decline of up to 12%, marking its largest drop in a single day since March 2020. This was primarily due to the fact that the infrastructure software company recorded a slowdown in its cloud sales growth during the quarter. As a result, investors are less excited about Oracle's attempts to expand in a highly competitive market.

Alibaba Group Holding Ltd. is placing great emphasis on artificial intelligence and user experience, as its new leadership team aims to regain customers and a larger market share amidst fierce competition.

Rene Haas, the CEO of Arm Ltd., is preparing for the largest public offering of the year and is encouraging potential investors to consider a shift in their approach.

An upcoming biography reveals that Elon Musk disregarded cautionary advice from trusted individuals, including David Zaslav from Warner Bros. Discovery Inc. and even his own sibling, about his unpredictable conduct leading advertisers to withdraw.

Anticipated profits are not expected to be significant.

(Tech Chart of the Day section provides updated information on stocks.)

The blog section that has gained the most readership on Bloomberg Businessweek is as follows:

The scarcity of ADHD medications has become more intense as manufacturers claim that they can no longer produce them beyond their capacity.

The news about James Dolan's $2.3 billion sphere is generating positive attention and interest.

The antitrust trial has brought attention to the connection between Google and Apple.

The unexpected release of Huawei's new phone is fueling doubts among those who question Joe Biden's stance on China. Rewritten: The sudden introduction of Huawei's latest phone is adding to the skepticism of those who are uncertain about Joe Biden's viewpoint on China.

The incidence of Lyme disease has increased significantly, and a potential vaccine is on the horizon.