Argentine Peso Slumps to Record as New Controls Squeeze Market - BNN Bloomberg

The data you asked for is currently unavailable, kindly revisit this page in the near future.

Ignacio Olivera Doll and Scott Squires, authors from Bloomberg News

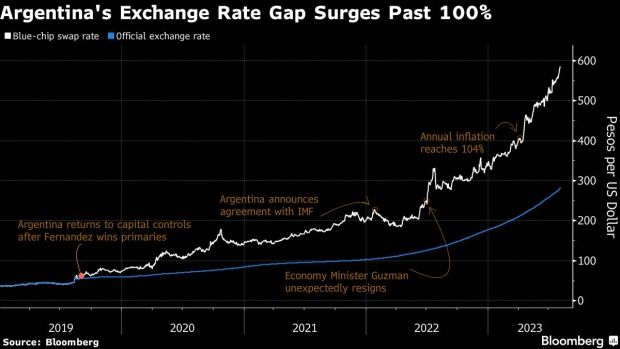

Argentina's currency, the peso, reached an all-time low in the unofficial exchange market, adding to the concerns of an unpredictable situation leading up to the crucial primary elections this Sunday.

The alternate exchange rate, referred to as the blue-chip swap in the local context, experienced a decline of approximately 1.7%, reaching around 591 pesos per dollar on Monday. Argentina's official exchange rate also decreased by up to 1.4%, marking the largest intraday drop since September 2020. Consequently, the disparity between these two rates has exceeded 109%.

Traders are under strain following the introduction of fresh limitations by Argentina's securities watchdog. These restrictions prohibit investors from engaging in trading dollar-based government bonds or American Depositary Receipts for a specific period of 15 days after conducting transactions in the domestic market. This particular maneuver is often employed as a way to avoid currency controls.

The limitations, made public on August 2, pertain to domestic brokers and encompass specific assets that can be converted into cash within two days. On August 7, the overseer directed brokers to abstain from engaging in transactions if they believe that they are violating the rules, without necessitating an official caution beforehand.

On August 13, the people of Argentina will head to the voting booths to select their presidential nominees, who will be competing against each other in an attempt to control the soaring triple-digit inflation and effectively handle an economy that is on the path towards a recession. The actual elections will take place in October.

The markets have been getting ready for the primaries for quite some time now. However, the possibility of devaluation has risen even more after private voter surveys, which are not usually disclosed in Argentina, revealed a smaller difference between the opposition and the ruling party. According to PPI, a local brokerage firm, the gap in voting preferences between the two parties decreased from 5.6 points to 2.4 points within the last month, based on an average of five surveys.

In a report published on Monday, PPI analysts, led by Pedro Siaba Serrate, stated that they do not observe any significant factors that could alleviate the intense dollarization pressure in the next five days leading up to the primaries. The analysts also mentioned that the blue-chip swap level might appear high in anticipation of an opposition victory, but it seems relatively affordable if the current coalition proves to be a tough competitor in the primary elections.

--With the help of Daniel Cancel.