Is Wyndham Hotels & Resorts (NYSE:WH) Using Too Much Debt?

Renowned money manager Li Lu (supported by Charlie Munger) once stated, 'The primary risk in investing is not the fluctuation of prices, but rather the potential of enduring a lasting reduction in capital.' Hence, it becomes apparent that when evaluating the risk associated with a particular stock, one should take into account its debt levels since excessive debt can lead to a company's downfall. Pertinently, Wyndham Hotels & Resorts, Inc. (NYSE:WH) does possess debt. Nonetheless, the crucial inquiry lies in determining the extent of risk that this debt actually poses.

When Does Debt Become Risky?

Debt is beneficial to a business until the business struggles to repay it, either through new funding or through available funds. A fundamental aspect of capitalism involves the process of 'creative destruction,' in which failed businesses are ruthlessly liquidated by their creditors. However, a more common (yet still costly) scenario arises when a company is forced to dilute its shareholders by offering shares at a discounted price in order to manage its debt. However, instead of dilution, debt can be an incredibly useful tool for businesses that require capital to invest in high-yield growth. The initial step in assessing a company's debt levels is to analyze its cash and debt collectively.

Take a look at our most recent examination of Wyndham Hotels & Resorts

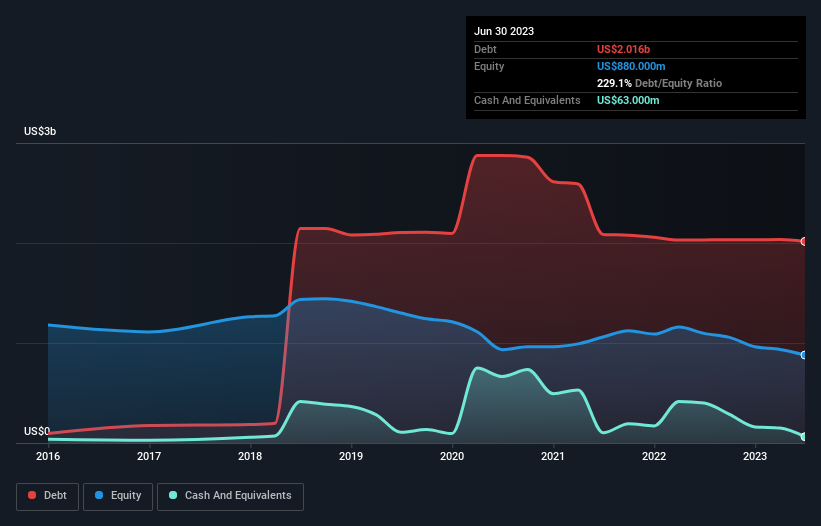

The graph provided underneath, accessible for a more comprehensive view, reveals that Wyndham Hotels & Resorts accrued a debt amounting to US$2.02 billion in June of 2023. This figure is approximately similar to the previous year's debt. Conversely, the company possessed a cash reserve of US$63 million, resulting in a net debt of US$1.95 billion.

Wyndham Hotels' Financial Strength: Impressive?

Based on the latest balance sheet data, it is evident that Wyndham Hotels & Resorts had debts of US$469.0m that are required to be settled within a year. Additionally, it had debts amounting to US$2.71b that are due in the future. However, the company has assets that can counterbalance these obligations, including US$63.0m in cash and US$261.0m in receivables that are expected to be obtained within the next 12 months. Therefore, when considering both its cash and short-term receivables, Wyndham Hotels & Resorts still faces liabilities that surpass their total amount by US$2.85b.

The shortfall is not really concerning since Wyndham Hotels & Resorts has a valuation of US$6.41b, and could potentially generate sufficient funds to strengthen its financial situation, if necessary. Nevertheless, it is essential to thoroughly examine its capacity to settle its debts.

We evaluate a corporation's debt burden compared to its ability to generate profits by examining its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA). Additionally, we determine the ability of its earnings before interest and tax (EBIT) to cover the costs of interest (interest cover). This approach enables us to take into account both the total amount of debt and the interest rates associated with it.

The debt of Wyndham Hotels & Resorts is 3.4 times its EBITDA, and its EBIT can cover its interest expense 5.7 times. This indicates that although the debt levels are significant, we would not classify them as problematic. Unfortunately, Wyndham Hotels & Resorts experienced a 5.5% decline in EBIT in the past year. If this trend of decreasing earnings continues, managing the debt will be challenging. When analyzing debt levels, it is important to start with the balance sheet. However, it is ultimately the future earnings that will determine Wyndham Hotels & Resorts' ability to maintain a healthy balance sheet. If you are interested in the future, you can refer to this free report that provides analyst profit forecasts.

In the end, a business can only settle its debts using actual money, not just profits on paper. Therefore, it is important to assess the amount of free cash flow that corresponds to the company's operating earnings (EBIT). Over the past three years, Wyndham Hotels & Resorts has generated a robust amount of free cash flow, equivalent to 76% of its EBIT, which is in line with our predictions. This actual money provides the company with the ability to decrease its debt whenever necessary.

When analyzing the financial health of Wyndham Hotels & Resorts, one positive aspect to highlight is its ability to confidently convert EBIT to free cash flow. However, there are other concerning observations we made. Specifically, the company's net debt to EBITDA ratio raises some concerns about its level of debt. After reviewing this information, we feel cautious about Wyndham Hotels & Resorts' debt levels. While debt can potentially lead to higher returns, shareholders should consider the increased risk associated with high levels of debt. It is important to note that the balance sheet provides valuable insights into a company's debt situation. However, it is crucial to acknowledge that there are external risks that can impact a company's financial stability. In our analysis of Wyndham Hotels & Resorts, we have identified three warning signs, at least one of which is particularly concerning. It is important for investors to understand and consider these warning signs during the investment decision-making process.

After everything is considered, there are times when it becomes simpler to concentrate on companies that do not require any borrowing. At present, readers can effortlessly obtain a catalog of growth stocks without any financial obligations, without any cost involved.

Simplifying Valuation: Our Guide

Discover if Wyndham Hotels & Resorts is possibly overpriced or undervalued by exploring our extensive examination, encompassing assessments of fair value, potential risks, cautionary indicators, dividend payouts, insider dealings, and overall financial stability.

Check out the complimentary assessment.

Do you have any thoughts about this article? Are you worried about the content? Contact us directly if you have any concerns. Alternatively, you can email us at editorial-team (at) simplywallst.com.

The blog section of this post from Simply Wall St is broad in scope. We offer insights based on past information and expert predictions using a fair approach, and our blog posts are not meant to serve as financial guidance. It does not serve as a suggestion to purchase or sell any stocks, and it does not consider your specific goals or financial status. Our goal is to provide analysis that is centered on long-term perspectives and influenced by fundamental data. Please be aware that our analysis may not include the most recent stock-related updates or qualitative materials. Simply Wall St does not hold any positions in the stocks mentioned.