UK microchip giant Arm files to sell shares in US

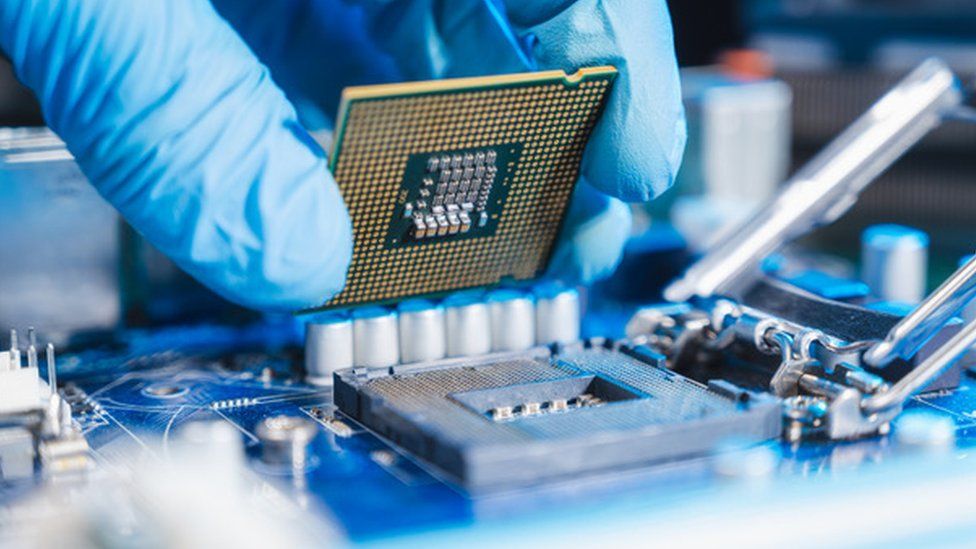

Picture credits, Getty Images.

Blogger in the field of commerce, BBC News

Arm, the prominent British company that specializes in designing microchips, has made a public declaration that it has submitted the necessary documentation for the purpose of trading its ownership stakes within the United States.

The firm, situated in Cambridge, is engaged in the production of microprocessors for a wide range of gadgets, including mobile phones and gaming consoles. They have intentions to go public on Nasdaq in September.

Arm did not disclose the amount of shares up for grabs or the cost, however its planned initial public offering (IPO) may potentially be the largest public debut of the year.

The company decided not to go ahead with the plan to list its shares in London in March, which disappointed the UK.

Arm made an announcement on Monday, stating that they have officially submitted a registration statement for a proposed initial public offering (IPO). They mentioned that details pertaining to the number of shares and their price range remained undecided at the moment.

However, it has been reported that the company is seeking an estimated worth ranging from $60 billion (£47 billion) to $70 billion (£55 billion).

Softbank, a Japanese conglomerate, acquired Arm in 2016 for a whopping £23.4bn. Before this acquisition, Arm had been listed on both the London and New York stock exchanges for a remarkable 18 years.

Manufacturers such as Taiwan Semiconductor Manufacturing Company, Apple, and Samsung utilize the chip design instructions and technologies provided by this company to fabricate their customized processors.

When a company is listed on a stock exchange, it undergoes a transformation from being privately held to becoming publicly traded. This allows investors to purchase and trade shares of the company's stock on designated exchanges.

Earlier reports indicated that the company had attempted to generate funds ranging from $8 billion to $10 billion by going public on the technologically-focused Nasdaq exchange. Some prominent tech giants such as Google, Apple, and Facebook also conduct their stock trading activities on Nasdaq.

What's An IPO?

To generate funds, private enterprises have the option to initiate a procedure of getting listed on a stock market.

During an initial public offering, companies provide shares to investors prior to being listed.

Usually, the value of the stocks is determined by the investment banks that the company has appointed to oversee the procedure.

However, when the shares become available for trading in the public market, their prices are determined by the interplay of supply and demand. The market value of the company is calculated by multiplying the value of each share by the total number of shares in circulation.

Arm was established in 1990 and has gained recognition as the most valuable asset in the British technology industry.

In January, there were reports stating that Prime Minister Rishi Sunak had initiated discussions once again with the owner of Arm, regarding the possibility of listing the company on the London Stock Exchange.

However, the company stated that it had no intention of seeking a listing in the UK, expressing that the US presented the most favorable route ahead.

The choice created worries that the UK market was not putting in sufficient effort to attract stock offerings from technology companies. It was believed that US exchanges provide greater prominence and valuations.

However, the CEO of Arm, Rene Haas, has stated that the company intends to retain its valuable intellectual property, main office, and activities within the boundaries of the United Kingdom.

The most recent submission indicates that Softbank is determined to move forward with the multi-billion dollar sale, despite challenging circumstances in the worldwide financial markets.

There has been a significant decline in the quantity of companies listed in the stock market following Russia's invasion of Ukraine. Additionally, the stocks of prominent technology firms have experienced a decrease in value due to the impact of the Covid pandemic.

Following a severe scarcity of semiconductors amidst the pandemic, the sector responsible for producing chips has encountered a decline in the level of demand.

The sales of Arm dropped to $2.68 billion in the fiscal year that ended on March 31, mainly due to a decrease in worldwide smartphone deliveries. During the three-month period ending on June 30, sales decreased by 2.5% to $675 million.