After Nvidia's last 'shock-and awe' earnings, here's what Wall Street expects from the 2nd-quarter report

Investors are eagerly anticipating Nvidia's financial report for the second quarter, which will be released after the market closes on Wednesday. The company, known for its AI chips, has raised the bar with its impressive revenue forecast in May, surpassing the predictions made by financial experts on Wall Street. Let's delve into what these experts are predicting for Nvidia's upcoming earnings report.

Something is in the process of being loaded.

Thank you for registering!

Discover your preferred subjects in a customized stream while being mobile.

Investors will keep a close eye on Nvidia this week as the company prepares to unveil its financial results for the second quarter, following the market closure on Wednesday.

The semiconductor manufacturer astounded market analysts in May with its projected revenue for the second quarter, surpassing Wall Street predictions by an incredible $4 billion.

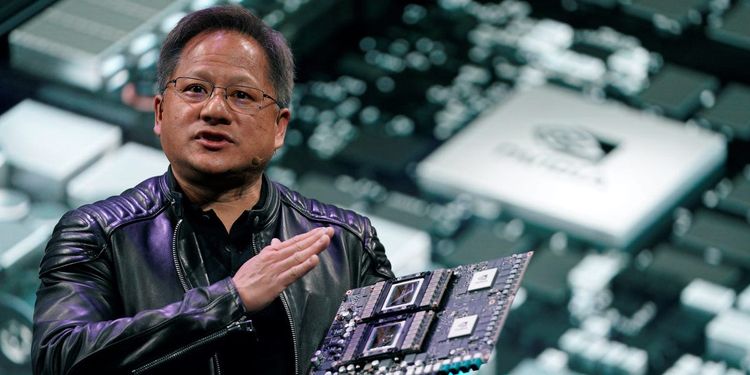

The business, which produces and vends graphics processing units used for AI chatbots such as ChatGPT, has observed a significant increase in demand for its goods in recent months, and it holds a dominant position in the AI chip industry.

"We heavily rely on Nvidia hardware. In fact, we are willing to maximize our usage as long as they can supply us with it promptly. To be honest, if they could provide us with a sufficient number of GPUs, we might not require Dojo. However, they are unable to do so due to their numerous customers," revealed Tesla CEO Elon Musk during the company's earnings call in July, discussing their second-quarter performance.

Nvidia's AI-centered enterprise has experienced a significant surge, leading to a staggering 200% increase in its stock value this year. As a result, the company's market worth has reached an impressive $1.1 trillion.

The majority of financial professionals on Wall Street anticipate Nvidia will continue to amaze investors with strong outcomes in the second quarter. Moreover, they anticipate the guidance provided for the latter half of the year to be even more impressive than initially anticipated. According to information from YahooFinance, the average estimate for earnings per share (EPS) for the quarter is $2.07, and the average estimate for revenue is $11.2 billion.

Discover what the financial experts at Wall Street have to say regarding Nvidia's imminent quarterly financial results.

Barclays: Nvidia, Top Choice For AI

In a recent statement, Barclays mentioned that based on their analysis of Nvidia's backend Asia checks, there is a possibility for the company's GPUs to generate revenue of up to $15 billion in Q3, with even higher potential in Q4. This indicates the likelihood of Nvidia outperforming expectations and potentially experiencing significant growth in the coming quarters.

The overall estimation for Data Center revenue in Q3, considering Mellanox, only amounts to $8.5 billion. AMD seems to have a promising position in the market as a potential leading rival, but it is unlikely that we will witness any initial indications of success until the following year. During this period, Nvidia will carry on dominating the majority of economic gains from the AI surge.

Barclays considers Nvidia as a strong investment and has given it a "Overweight" rating. They have set a target price of $600 for the stock.

Bank Of America: Going Beyond Shock To Progress

According to a recent statement by Bank of America, Nvidia is a highly recommended investment choice due to its strong position in the market and its potential for growth in the AI and accelerated computing sectors. The company has a significant advantage in its ability to transform traditional data centers into AI-focused ones, which is a market worth more than $1 trillion. While the previous quarter’s report was impressive, it is anticipated that this quarter's sentiment may be more cautious. The main challenge lies in the supply chain, particularly in packaging and memory, as well as the speed at which American cloud service providers can implement genAI compute instances.

BofA stated that Nvidia is not expected to provide guidance for future quarters. However, it is advised to pay attention to what management says about the ongoing increase in sales or if they mention it being in the early stages. After the earnings are announced, there might be a temporary period of stock consolidation due to a significant increase of over 200% this year (in contrast to the 46% increase in SOX).

Bank of America gives Nvidia a "Buy" rating and sets a target price of $550.

Goldman Sachs Outlook: Promising Future

Goldman Sachs stated in a recent note that they believe the company has a strong position in the AI semiconductor market, which is experiencing rapid growth. They expect the company's earnings per share to exceed market expectations, leading to continued success in the stock market for the rest of the year.

Goldman Sachs has given Nvidia a "Buy" rating, suggesting that it would be a good idea to purchase the stock. They have also set a price target of $495, indicating their belief that the stock's value will reach this level.