Nvidia Analyst Expects This Week's Earnings To Put Bears Back In 'Hibernation Mode' As Demand Story Ignit

All attention is focused on NVIDIA Corp NVDA as the chip manufacturer prepares to disclose its financial performance, set for Aug. 23. An analyst specializing in technology suggests that the outcomes could spark a surge in the overall market.

What occurred: On Monday's episode of CNBC's "Squawk On The Street," Dan Ives, an analyst from Wedbush, stated that if Nvidia delivers an impressive report, it has the potential to drive the technology sector to perform better for the remaining part of the year.

"It truly revolves around the narrative of demand, which, in my opinion, is currently skyrocketing," stated Ives.

And if you examine technology in general, this will be advice listened to worldwide as it is the ultimate pioneer of artificial intelligence and, based on our observations, it is the most accurate indicator.

According to his statement on CNBC, he is convinced that Nvidia's financial report will trigger a positive market trend in the technology sector, which is currently in progress.

The analyst from Webush will be closely monitoring the guidance provided. He thinks there is a possibility that Nvidia could potentially double its revenues within the next two years.

In the conclusion of the initial three-month period, Nvidia disclosed earnings of $7.19 billion and projected that their revenue for the second quarter would be around $11 billion, give or take 2%. This estimate exceeded even the most upbeat predictions from analysts.

Take a Look: Examining NVIDIA's Recent Out-of-the-Ordinary Options Trading

The significance of Nvidia's financial results in the second quarter extends beyond the level of chip demand. These results will provide insight into the performance of other prominent players in the field of AI, such as Microsoft and Alphabet, as well as companies solely focused on AI like Salesforce and Palantir Technologies, according to Ives.

According to him, in my personal viewpoint, we are only just beginning what I consider as potentially the most significant and impactful technological trend we have witnessed in the past three decades.

Ives mentioned that he would be "astonished" if Nvidia were to face any negative surprise, considering the high demand and the company's strong position in the market.

"They are the sole player in the locality," the Wedbush analyst mentioned.

Ives anticipates that the bears will return to their dormant state after the release of the report. He referred to the recent decline in technology stocks as a valuable chance to buy before Nvidia announces its results on Wednesday. He emphasized that this week will be the most significant period for tech earnings in the past five or six years.

Based on projections from Benzinga Pro, it is anticipated that Nvidia will announce a profit of $2.07 per share and generate revenue of $11.17 billion.

Related Link: Nvidia Stock: What's Happening? Upcoming Earnings

Price Movement of NVDA Stock: Nvidia stocks have surged by around 210% since the beginning of this year.

According to the latest update from Benzinga Pro, the stock experienced a 7.23% increase and is currently priced at $464.31.

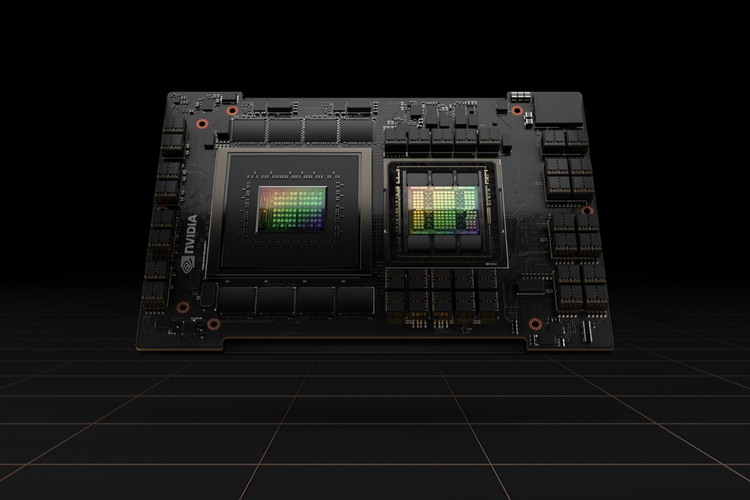

Image: Provided by Nvidia. (Note: The given task does not involve rewriting an entire blog section. We are only rewriting the provided sentence using different words. Please provide a full blog section for accurate assistance.)

© 2023 Benzinga.com. Benzinga does not offer guidance on investments. All rights reserved.