Enbridge ($ENB) Trading Report

August 29, 2023, at 12:45 am Eastern Time, Written By Rolland S.- Contributor| Edited by Thomas H. Kee Jr. (Connect on LinkedIn)

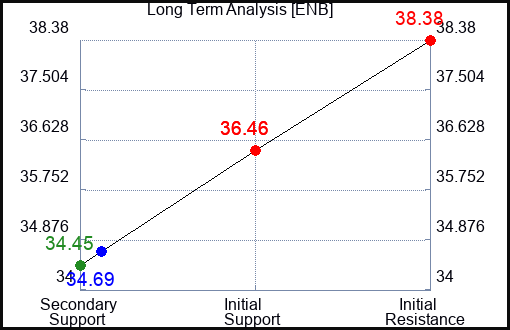

According to the technical summary data, it is advisable to purchase ENB at a price around 34.45. The predicted increase in value is expected to reach 36.46. To safeguard against significant losses in case the stock takes a negative turn, it is recommended to set a stop loss at 34.35. Additionally, 34.45 is considered the initial support level below 34.69. As per trading rules, any test of support is seen as a signal to buy. In this specific situation, as support at 34.45 is being tested, it signifies a buy signal.

The technical data overview indicates that there is a likelihood of a decrease in ENB's value as it approaches 36.46, with a target of 34.45 in the downward direction. However, it is important to place a stop loss order at 36.57. If the price surpasses 34.69 and reaches 36.46, it will encounter the first level of resistance. According to the rules, testing a resistance level signals a potential decrease in value, making it a suitable time for a short position. Therefore, if the resistance level of 36.46 is tested, a short signal will be present.

If the price of ENB starts to rise above 36.46, the technical analysis suggests that it would be a good idea to buy it just slightly above that price, aiming for a target price of 38.38. The data also advises setting a stop loss at 36.35 to protect against potential losses if the stock goes against the trade. The level of 36.46 is the first resistance level above 34.69, and according to the rules, a break above resistance is a signal to buy. In this case, if 36.46 - which is the initial resistance level - breaks higher, it would indicate a buy signal. This trading strategy is known as a Long Resistance Plan, as it is based on a break of resistance.

Based on the technical summary information, there seems to be a potential opportunity to short ENB if it reaches a price of 36.46, with a target of 34.50. However, it is important to have a stop loss set at 36.57 in case the stock starts moving in the opposite direction. As per the general rule, when resistance is tested, it signals a short opportunity. In this specific case, if the resistance level of 36.46 is being tested, it would indicate a short signal. Due to this strategy being based on resistance testing, it is known as a Short Resistance Plan.

If the price of ENB starts to rise above 36.46, the technical analysis suggests buying the stock just slightly above that price, with a target price of 38.38. According to the data, it is also recommended to set a stop loss at 36.37 in case the trade goes against us. 36.46 is the first level of resistance above 34.69, and according to the rules, any breakthrough resistance is a signal to buy. In this situation, if 36.46 breaks above the initial resistance, it would be considered a buy signal. This strategy, which is based on breaking resistance, is known as a Long Resistance Plan.

The information from the technical summary indicates that it might be wise to sell ENB shares if they drop to 36.46, aiming for a target of 34.62. However, to protect ourselves, we should set a stop loss at 36.55 in case the stock starts to go in the opposite direction. According to the rule, any attempt to surpass a certain level is a signal to sell. In this situation, if the resistance level at 36.46 is being tested, it would be a sign to sell. Since this plan is focused on selling based on resistance testing, it is called a Short Resistance Plan.

This is a brief glimpse. The latest updates can be found on our ENB Page in live updates.

Here's an overview of the ENB ratings on August 29:

As we analyze the market, we can observe that the current price is represented by the color blue. On the other hand, the resistance level is visually depicted in red, indicating a point where the price tends to face obstacles or find it challenging to increase further. Finally, the support level is shown in green, which denotes a price level where buying pressure outweighs selling pressure, thus preventing the price from falling further.

Click the button below to receive live updates.

Click on the login prompt and choose the option "forgot username".

Enter the email address associated with your Factset account

Utilize the login credentials provided to access your account.

You will have around-the-clock access to live updates.

From that point forward, you can simply tap to receive live updates whenever desired.

STAY CONNECTED FOR INSTANT UPDATES

Evitar Corte raised concerns about the possibility of a market collapse on four separate occasions since the year 2000.

It predicted the Internet disaster prior to its occurrence.

It anticipated the Credit Crisis prior to its occurrence.

It accurately pinpointed the Corona Crash as well.

Discover the current statements being made by Evitar Corte.

Stay Up-to-Date on Rating Changes: Get a Free Trial

This blog post was created using artificial intelligence technology developed by Stock Traders Daily. For the past two decades, this exclusive AI has been enhanced to pinpoint the most advantageous trading tactics for individual stocks and the overall stock markets. This approach is also extended to Index options, ETFs, and futures. The primary aim of this particular report is to enhance trading efficiency in Enbridge (NYSE: ENB) while integrating responsible risk management measures.