XLE: The Oil And Gas Shortage Is About To Return With Force (NYSEARCA:XLE)

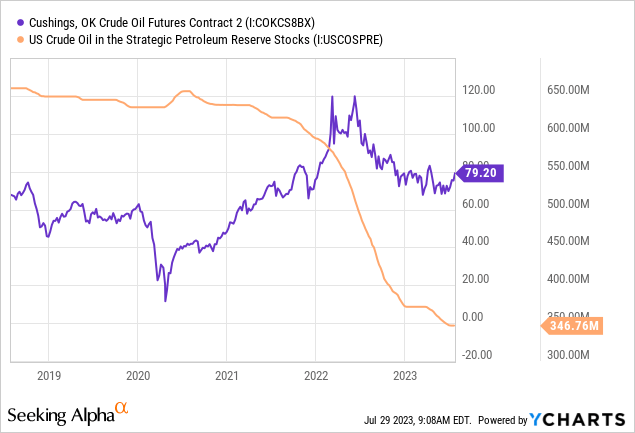

Following a period of substantial increases in energy prices from 2021 to early 2022, the market has entered a prolonged period of tranquility in the past year. The prices of crude oil and gasoline experienced a significant decline due to the release of reserves from the Strategic Petroleum Reserve, which artificially resolved the shortage. As a result, levels of inflation have decreased, leading many investors to adopt a more positive outlook on most stocks while avoiding investments in energy companies. I maintained a positive stance on the energy market during the period from 2021 to early 2022, but I also cautioned that government intervention would likely bring an end to the upward trend in May of last year. Currently, fuel prices are generally lower, although recent patterns suggest the potential for a more substantial rally in energy prices. See the details below:

The strong uptrend in the market was effectively halted by significant interference caused by reducing the SPR reserve by approximately half. The program initiated by the US government to release oil from the SPR was intended to conclude at the start of the year, but the available supply has decreased slightly. Nevertheless, it is expected that the SPR will no longer experience a decline in its supply and may even withdraw oil from the private market as the Biden administration aims to replenish the reserves that were lost. Although the government has made some limited purchase agreements to refill the reserve, many experts question their capacity to successfully restore the reserve due to inadequate surplus capability.

I believe that the release of the SPR reserve was similar to the quantitative easing conducted by the Federal Reserve. This action definitely helps the economy and lessens the burden of prices, but it has its drawbacks and is only a temporary solution. In fact, because of the decrease in oil and gas prices, most companies are reducing the number of active drilling rigs, which suggests that overall oil production in the US will likely decrease in the next few months. Additionally, OPEC+ has recently implemented more significant cuts in production, indicating a general decrease in global production as a response to the lower prices. As a matter of fact, oil prices are starting to reach the point where they are close to the minimum amount needed to cover the costs of drilling a new well. This minimum, also known as the breakeven price, has been rising due to shortages in labor and materials. Therefore, oil producers have no other choice but to decrease the rate at which they are drilling.

The current situation creates solid circumstances for a potential surge in oil, gasoline, and perhaps natural gas. The main energy exchange-traded fund (ETF), Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE), has started to show positive results and is approaching its highest point of May 2022. However, it is still possible that a recession could lead to a significant decline in demand, which would counteract the negative production outlook. Furthermore, the stocks within XLE may be currently overpriced based on their immediate earnings potential. Nevertheless, the continuous lack of investment in the energy market combined with high and steady global demand is likely to stimulate a considerable rally in energy commodity prices, which could greatly benefit XLE.

Less Investment, Less Production

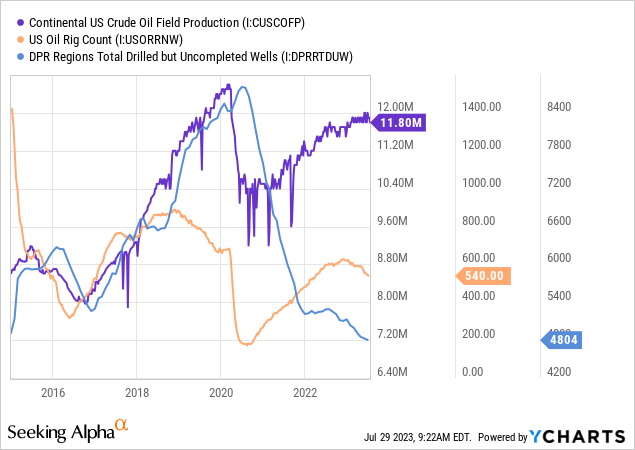

Oil production in the mainland United States is still significantly lower than before the COVID-19 outbreak, although it has shown some improvement since hitting its lowest point in 2020. The future of production relies heavily on the number of operational oil rigs. Moreover, to ensure a consistent level of output, the count of oil rigs needs to stay within a specific range, probably around 400-600. This is because new wells have to be continuously drilled to compensate for the declining output from older wells.

Especially when it comes to shale wells extracted through fracking (which is the most popular method in the United States), the amount of oil they produce significantly decreases by around 70-80% in the first year and over 95% by the third year. I bring up this point in my articles about energy because it demonstrates just how much the oil supply in the US relies on constantly drilling new wells. In 2020, when drilling activity experienced a notable decline, it resulted in a substantial and ongoing shortage of oil production due to the market's increasingly short-term focus. To make matters even more drastic, US oil producers have already utilized most of their inventory of drilled but unfinished wells, meaning that a higher number of drilling rigs is necessary to maintain consistent production. You can see the data below:

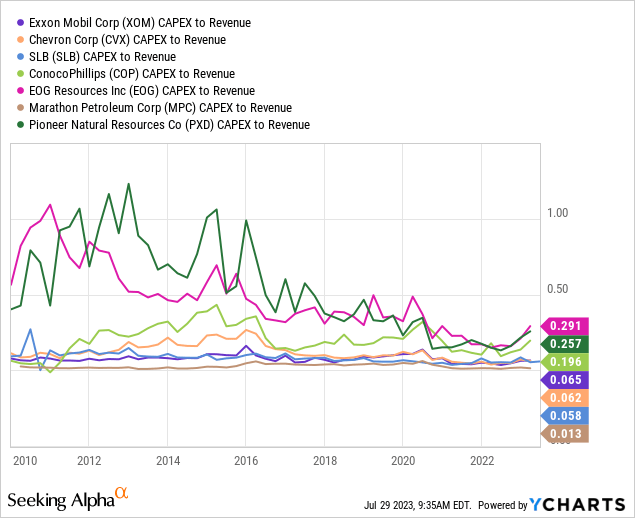

Today, there is a decrease in the number of rigs, which is correlated with the count of drilled but uncompleted wells. If this pattern continues, the overall production of oil is likely to decrease significantly. While I don't anticipate a drop in production as dramatic as we saw in 2020, it could possibly decline at a faster rate compared to previous similar situations, such as in 2016. In fact, much of the growth in production since the lowest point in 2020 has been driven by the completion of wells that were previously drilled but not yet brought into operation. This trend is largely a result of oil companies avoiding spending on capital expenditure for various reasons. As evidence, we can examine the capital expenditure to sales ratios of the major stocks in the XLE sector.

A lot of these companies have decreased their capital expenditure (CapEx) spending over the last decade due to the rapid growth of the US shale industry. EOG, ConocoPhillips, and Pioneer have seen a small increase in CapEx levels, but larger players like Chevron and Exxon have seen much smaller increases. The slight rise in capital investments in the past year reflects the slight increase in the number of drilling rigs. However, the decreasing rig count is likely an indication that CapEx spending will decrease in the third and fourth quarters.

In general, higher profits usually lead to increased capital expenditure (CapEx) spending. However, this is not the case at present, especially compared to the period between 2010 and 2019. Energy companies are now actively avoiding making investments whenever possible. This is mainly due to the fact that many of these companies still have high debt levels resulting from continuous losses experienced from 2014 to 2019. Instead of using their profits for drilling, they have chosen to prioritize reducing their debt. Additionally, there is a growing emphasis on environmental, social, and governance (ESG) initiatives, which has led to a decrease in production and an increase in debt costs. This trend is also reflected in the government's efforts to impose higher drilling costs on Federal lands, which in turn decreases the return on investment (ROI) for drilling activities. Moreover, the energy and mining industries are currently facing significant labor shortages, making it difficult to carry out drilling operations and driving up the cost of materials required for drilling (which are often metal-intensive). Lastly, certain oil sources, such as shale, are becoming increasingly depleted, with the easily accessible reserves being substantially tapped out already. This further diminishes the ROI for drilling.

All these elements are essentially long-term and contribute to keeping the breakeven drilling costs on a consistently positive trajectory. According to the CEO of Pioneer, it is improbable that the US will ever achieve record-breaking oil production again. While increased drilling costs may not necessarily benefit oil companies, as their profits could decline if the commodity does not maintain its positive momentum. On the other hand, natural gas presents a more substantial challenge as it currently trades below the breakeven price for many producers. Refineries and midstream companies are less susceptible to these challenges, but they might encounter difficulties due to rising expenses as capacity levels weaken.

Having said that, ESG-related initiatives and other factors that restrict production (such as labor shortages) can also work in favor of energy producers as they limit overall production levels. Individually, energy companies strive to maximize production. However, as a group, energy companies benefit from minimizing production, unlike the OPEC cartel. Since around 2010, OPEC has faced a major challenge due to the significant increase in US production, which limits its ability to control the market. Nevertheless, if US (and Canadian) oil output is limited for reasons that are not primarily economic, OPEC+ gains more power and could benefit from reducing its supplies. Additionally, the cartel is seeking to expand its membership, thereby further enhancing its control over the market.

In the same way, if the international influence of the US dollar were to decrease, the BRICS countries' efforts could potentially lead to an increase in US oil prices. Many nations are engaging in agreements that chip away at the overall value of the Petrodollar system. I think it is unlikely that the countries involved in this strategy will openly disclose the full extent of their plans because most of them, like China, hold significant assets in US dollars. China has been selling off these assets but still benefits from a strong dollar until it has reduced its exposure. While this is just speculation on my part, I believe there is a considerable risk of an unexpected negative event related to the US dollar, like a "black swan", in the upcoming year as these nations start revealing their currency intentions more publicly. If the US dollar experiences a sharp decline, which is currently relatively high in value, it would be highly advantageous for the oil industry and benefit US oil producers and exporters.

XLE's Vulnerability To Recession

In my opinion, if demand remains steady, there is a high chance that both crude oil and gasoline prices will go up. Additionally, it seems probable that natural gas prices will also increase, although I don't think they will reach the peak levels of 2022 anytime soon. XLE focuses on larger energy companies that are involved in various aspects of the industry, including production, exploration, transportation, and refining. If energy commodity prices experience a significant increase, it will benefit the companies involved in production and exploration the most. This could create a great opportunity for ETFs like the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). However, if energy commodity prices fail to rise, I anticipate a decline in this particular subindustry since current prices aren't high enough to generate significant profits like in 2022. Therefore, XLE might offer the best overall potential because it has the upside potential from exploration and production, as well as immediate high profits from refineries and transportation companies.

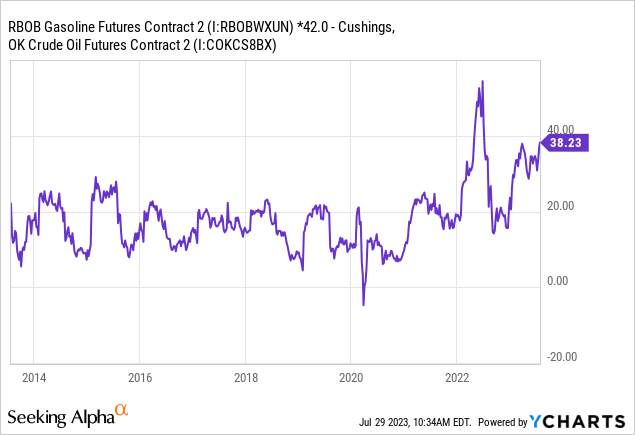

Refineries are likely the most favorable industry at present because of the recent surge in the gasoline "crack spread," which indicates the disparity between the cost of a gallon of gasoline and crude oil prices. Please refer to the information provided below:

The difference between the prices of crude oil and petroleum products continues to stay high compared to the pre-COVID era. This is primarily because there is a significant scarcity of refinery capacity and the existing refining infrastructure is in a deteriorated state. The situation is not expected to improve in the coming years as the United States faces challenges in expanding its refinery capacity. The reason behind this is that building new refineries requires huge investments, which are currently unattractive because of the promising long-term prospects of electric vehicles. Consequently, the existing refineries are able to operate in a monopolistic manner, ensuring they make substantial profits. However, collusion among these refineries is not necessary due to various obstacles that hinder capital investments in the industry.

However, the continued recession or extended economic slowdown poses challenges for all energy companies. From what I have discussed in my previous articles, I anticipate the US economy to gradually decline without experiencing a crash like in 2008. Instead, it will be a slow and continuous decline, leading to reduced incomes for both businesses and households over the coming years. Furthermore, considering the possibility of higher inflation rates than officially stated, the US real GDP and wages have been gradually decreasing since 2021. A sudden increase in fuel prices or a decline in the value of the dollar will undoubtedly hasten this decline, which I believe will continue until the US manufacturing sector improves, possibly even taking more than a decade.

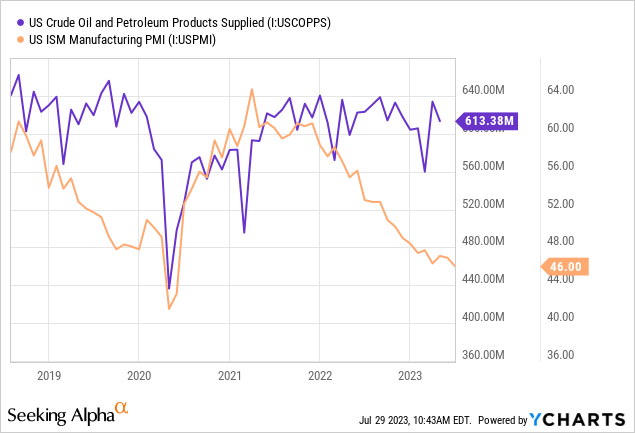

However, the demand for oil in the United States has continued to be exceptionally high this year, even though there has been a significant decrease in the rate of growth in manufacturing as a whole. Refer to the information presented below:

From my perspective, this information provides initial evidence that the economy doesn't have as much influence on the demand for oil and gas as many people think. The efficiency of fuel has greatly improved in the last twenty years (think about Hummers), which means that households and businesses don't have many easy options to decrease their consumption while still maintaining their ability to move around and operate. Eventually, electric vehicles will likely lead to lower demand. However, there are still significant obstacles in the short and long term such as high prices, reliance on tax credits, outdated power grids, and shortages of materials that prevent growth in this area. Therefore, although an economic recession could reduce demand, I don't believe we will see the same pattern as in 2008, when significant improvements in vehicle efficiency played a major role. Moreover, I anticipate that demand will only decrease in response to a sudden rise in fuel prices.

XLE is currently trading at a P/E ratio of 7.75X, which is lower when looking at the past twelve months. During this period, energy prices were significantly lower compared to 2021 and early 2022. However, profits have remained high thanks to hedging activities and long-term contracts that were established when prices were higher. Looking ahead, the fund's forward P/E ratio is 11.75X, indicating a decrease in earnings due to the current lower commodity prices. Moreover, XLE offers a dividend yield of 3.4% after accounting for its expense ratio. While this may not be considered high when compared to interest rates, it is still better than what is typically seen in most other industries.

In general, I feel very optimistic about the XLE today and think that its value is relatively low, especially considering the possibility of higher commodity prices. In my opinion, there are strong technical and fundamental factors that could lead to a significant increase in oil and gasoline prices in the coming months, which could drive the XLE to much higher levels. However, it's important to note that the XLE is still exposed to economic risks and may decline if the S&P 500 experiences another selloff. That being said, I believe that the XLE is less prone to recessions compared to other sector ETFs, thanks to various long-term trends that are benefiting the oil and gas market. Speculative investors may find better results in E&P-focused ETFs like XOP, but personally, I prefer the XLE because of the anticipated profit growth from refineries. This gives the XLE a positive exposure to commodities and a good potential for immediate value.

the author of this blog post is

Harrison is an individual who specializes in analyzing financial information and has been contributing to Seeking Alpha since 2018. Over the span of ten years, he has maintained a keen interest in monitoring market trends. Additionally, Harrison possesses valuable expertise gained from working in private equity, real estate, and economic research sectors. In terms of education, he has pursued studies in financial econometrics, economic forecasting, and global monetary economics.

Note: I want to clarify that I do not have any investments, be it stocks, options, or any related derivatives, in the companies mentioned. However, I may decide to initiate a long position by purchasing the stock, call options, or similar derivatives in USO or XLE within the next 72 hours. The words expressed in this article are solely my own and I have not been compensated for it, excluding potential compensation from Seeking Alpha. I do not have any affiliations with the companies mentioned in this article.

Disclosure by Seeking Alpha: Previous results do not guarantee future outcomes. We do not provide recommendations or advice on the suitability of investments for individual investors. Any opinions expressed above may not represent the views of Seeking Alpha as a whole. Seeking Alpha is not a licensed broker, securities dealer, US investment adviser, or investment bank. Our analysts consist of third-party authors, including professional and individual investors who may lack licensing or certification from any institution or regulatory body.