CISO Global Inc. (NASDAQ:CISO) Screens Well But There Might Be A Catch

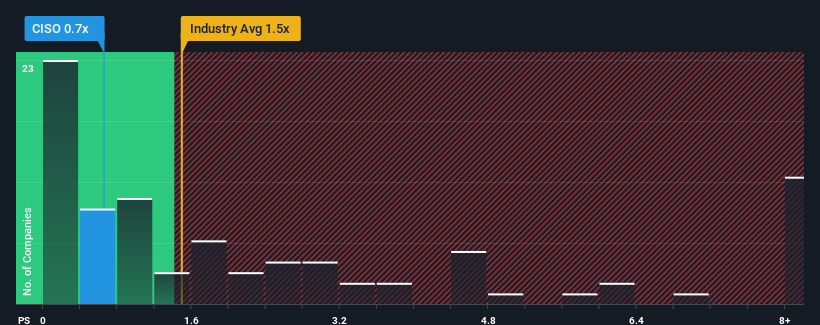

The current P/S ratio of CISO Global Inc. (NASDAQ:CISO) is 0.7x, which seems like a good opportunity to invest since it is lower compared to the IT industry in the United States. Majority of the companies in the US IT industry have P/S ratios above 1.5x and some even have P/S ratios above 4x. Nonetheless, it is crucial to look into the reason behind the low P/S ratio of CISO and conduct further research to make an informed investment decision.

Take a look at our most recent examination for CISO Global.

Impact Of CISO Global's P/S On Shareholders?

Recently, CISO Global has been excelling in their revenue growth, surpassing many other companies. However, there is speculation that the low P/S ratio may be due to investors doubting the sustainability of this growth in the future. If CISO Global can maintain their current trajectory, their share price should eventually reflect their impressive revenue figures as a result.

If you want to have a complete understanding of what the analysts think about the company, then you should check out our complimentary report on CISO Global. This report will reveal the future plans and strategies of the company.

CISO Global's Revenue: Upward Trend?

You'll only feel at ease when you see a P/S as low as the one at CISO Global if the company's progress is headed towards falling behind the rest of the sector.

Looking back at the past year, the company experienced an impressive surge of 133% in its revenue growth. Over the course of the last three years, there has been a remarkable and steady increase in revenue, which has been further boosted by the company's outstanding performance in the short term. Consequently, it is reasonable to affirm that the company has been achieving a remarkable and magnificent revenue growth lately.

Looking ahead, the predictions from the sole analyst examining the organization imply that there will be a 57% increase in revenue within the next year. In contrast, the rest of the sector is expected to experience a growth rate of only 11%, which is substantially less desirable.

Based on this data, we find it strange that CISO Global is being sold at a P/S ratio that is lower than the industry average. It seems that certain investors are skeptical about the company's projections and have agreed to much lower prices when selling their shares.

Learning From CISO Global's P/S

Relying solely on the price-to-sales ratio as a means to decide whether to sell your stock is not wise. Nevertheless, it can serve as a useful indicator of the company's potential for growth.

When we examine the revenue of CISO Global, we can see that even though predictions show a bright future for growth, the P/S ratio is lower than what we would anticipate. This suggests that there may be some significant risks involved that are causing the P/S ratio to decrease. We can assume that the market is anticipating revenue uncertainty, which would normally result in an increase in the share price.

Prior to finalizing your stance, we have identified 5 cautionary indications for CISO Global (one of which may be unfavorable) that it is important to take note of.

Looking for a good company is crucial instead of settling for the first option that comes your way. If enhancing profitability is what you're after, check out this list of exciting companies that have displayed tremendous earnings growth lately, along with a low P/E ratio.

Do you have any thoughts about this article that you'd like to share? Are you worried about the information discussed? Don't hesitate to contact us directly or send an email to editorial-team (at) simplywallst.com.

The content of this article from Simply Wall St has a broad focus. Our team offers insights based on past statistics and expert predictions. We use objective techniques when sharing information and our articles are not meant to be financial guidance. We don't suggest buying or selling stocks, and we don't take into account your specific financial needs and goals. Our goal is to provide in-depth analysis centered on essential data that's relevant over the long-term. Keep in mind that our evaluation may not include the most recent company disclosures or subjective factors. Simply Wall St has no vested interest in any of the stocks cited in this article.

Participate in a User Research Session for Payment Assist us in enhancing investing tools for individuals such as you and earn a US$30 Amazon Gift card for one hour of your valuable time. Register yourself here.