Shareholders in indie Semiconductor (NASDAQ:INDI) have lost 37%, as stock drops 8.5% this past week

Many investors choose to pick individual stocks in order to achieve higher returns compared to the overall market. However, the downside of stock picking is that there is a possibility of selecting underperforming companies. Unfortunately, long-term investors of indie Semiconductor, Inc. (NASDAQ: INDI) have experienced this as its share price has declined by 37% in the past three years, while the market has seen a return of approximately 24%. Additionally, the share price has dropped by 21% in the last year, which is unlikely to please many shareholders. The decline in share price has been even more pronounced recently, with a 33% decrease in the past three months. This may be attributed to the company's latest financial results, which can be further understood by referring to our company report.

Considering the difficult week experienced by shareholders, it is worthwhile to examine the basic principles and extract valuable insights.

Take a look at our most recent evaluation for indie Semiconductor.

indie Semiconductor is not currently making a profit, hence, most analysts would rely on the increase in revenue to gauge the pace of the underlying business expansion. Shareholders of unprofitable companies generally anticipate robust revenue growth. It's worth noting that rapid revenue growth, if sustained, frequently results in swift profit expansion.

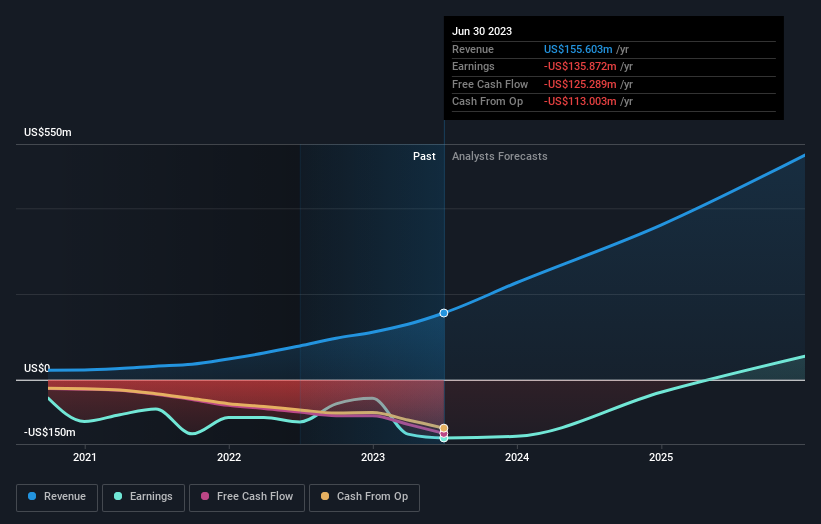

Over the past three years, indie Semiconductor experienced an annual revenue surge of 71%, continuously expanding. This growth rate surpasses that of the majority of companies yet to generate profits. However, the decline in share price of 11% per year throughout this period may be deemed underwhelming, suggesting that the company's remarkable revenue growth has not been duly acknowledged. It appears that the actual expansion might have fallen short of shareholders' anticipations. Nevertheless, as optimism wanes and expectations become more realistic, the current situation could potentially present a favorable moment for investment.

The picture displayed beneath illustrates the progression of earnings and revenue over a period of time (for a clearer view, click on the image).

If you wish to further explore indie Semiconductor's stock, this interactive report on their balance sheet strength is an excellent starting point.

The indie Semiconductor shares did not perform well in the past year, experiencing a decrease of 21%, while the overall market saw a 7.9% increase. However, it's important to remember that long-term performance is more significant than short-term fluctuations, and even successful stocks can have a down year. Looking at the past three years, the company has had an average annual loss of 11%, which implies that they have not successfully addressed their issues to gain market confidence. While there is a famous saying by Baron Rothschild to invest during times of crisis, he also emphasizes the importance of choosing high-quality stocks with promising futures. It is always intriguing to analyze the stock's performance over a longer period. However, to better understand indie Semiconductor, we need to take into account various other factors. In fact, we have identified two warning signs for indie Semiconductor that investors should be mindful of before making any investments.

However, it is important to mention that indie Semiconductor might not be the most ideal stock option to invest in. Therefore, it would be beneficial to have a look at this complimentary compilation of captivating businesses that have shown previous earnings growth (and are also projected to have future growth).

Please keep in mind that the market gains mentioned in this blog post represent the average returns of stocks currently being traded on American stock exchanges.

Simplifying Valuation: Our Expertise Makes It Easier

Discover if indie Semiconductor is potentially over or underpriced by exploring our in-depth assessment, encompassing evaluations of fair value, hazards and cautions, payouts, insider dealings, and fiscal condition.

Take a look at the complimentary analysis.

Do you have any thoughts about this article? Are you worried about the information provided? Contact us directly with your feedback. Alternatively, you can send an email to the editorial team at editorial-team (at) simplywallst.com.

This blog post from Simply Wall St is of a general nature. We offer insights based on past information and expert predictions, using a fair and objective approach. Our articles should not be considered as financial guidance and do not suggest any specific buying or selling of stocks. They do not take into consideration your personal goals or financial conditions. Our objective is to provide thorough analysis that focuses on the long-term by using fundamental data. Please note that our analysis may not include the most recent price-related announcements or qualitative information about the company. Simply Wall St does not have any investment positions in the stocks mentioned.