Tesla Stock: Get Off The High (Risk) Way (NASDAQ:TSLA)

Tesla, Inc. (NASDAQ:TSLA) is slowly losing the profits it gained from its rally this year, declining approximately 9% in the last five days. We still recommend selling the stock; we may have been premature in our bearish stance towards the end of last year, but we still envision a decline for the stock. We don't think the increase in value this year was driven by fundamental factors.

After conducting a thorough examination of Tesla based on its core aspects, it seems that the stock is currently priced higher than its actual value. Additionally, the company's profit margins are shrinking as a result of CEO Elon Musk's approach of reducing prices. However, this strategy did not lead to a substantial increase in demand, and external factors affecting the overall spending habits of consumers are also having an impact. To compound matters, concerns regarding a scarcity of lithium have arisen due to problems in the supply chain.

We have a positive outlook on the future prospects of electric vehicles ("EVs"), but we do not believe that the stock will perform well in the short term. Our suggestion for investors is to consider selling their positions at current prices.

Don't Overlook Margins Or The Risk Of Losing Market Share

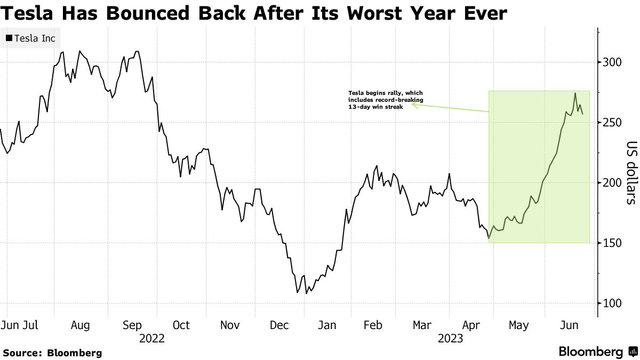

The stock has experienced a significant recovery after its most challenging year, having declined by 65% in 2022. This year, the stocks have more than doubled, showing a YTD increase of 131%. This performance has surpassed the S&P 500 (SP500) by approximately 116%. Currently, we are observing indications that the company's impressive rally is beginning to decline. We believe this is due to the stock being excessively purchased based on the optimism surrounding Tesla's A.I. capabilities and the company's expansion through price reductions.

The graph provided illustrates the financial performance of Tesla's stocks during the period spanning from 2022 to 2023.

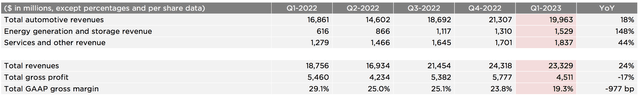

Tesla's decision to lower prices has negatively impacted the company's gross margins. According to reports, the company's total GAAP gross margin of 19.3% fell short of initial estimates of 22.4%. This is the lowest gross profit margin since the fourth quarter of 2020. It seems that Tesla's CEO, Elon Musk, prioritized increasing sales volume over maintaining higher profit margins. However, recent developments suggest that Musk is now attempting to reverse this strategy by raising prices once again. The price cuts implemented by Tesla aimed to make the purchase of Model 3 and Model Y vehicles more affordable, with the goal of stimulating consumer demand. This move was made amidst challenging market conditions that have limited consumer spending. We believe that this price cut strategy also serves as Musk's effort to retain and expand Tesla's market share in the face of increasing competition. This is particularly important as the S&P has predicted a decline in Tesla's market share to less than 20% by 2025, compared to its dominant share of 79% in 2020.

Surprisingly, the company commenced incrementing the prices of their vehicles in May, specifically the Model 3 and Model Y, in various countries such as the United States, Canada, Japan, and China. However, it is worth noting that despite the increase, Tesla's vehicle prices are still comparatively lower than they were at the beginning of the year. It is evident that the company is making adjustments to their prices in response to the overall economic situation, and some experts speculate that they may have initiated a price battle with their rivals.

In essence, Musk's reduction in prices has not succeeded in greatly increasing demand; last quarter, production still exceeded deliveries. Additionally, Tesla's portion of the electric vehicle market is precarious; analysts at Bank of America predict the company's share to decline to 18% by 2026, a significant decrease from the 62% share Tesla held just last year. Tesla is experiencing an excess supply problem as production continues to surpass deliveries for the past four quarters. The chart below illustrates the comparison of Tesla's production and deliveries in the first quarter of 2023.

Tesla's first quarter of 2023 production and deliveries

Furthermore, the reductions in prices are causing a decrease in the profit made per vehicle. The overall gross margin profit for the company has decreased compared to the previous year and in consecutive periods. Despite implementing price cuts, the total revenue generated from automotive sales has also decreased from 21,307M to 19,963M in sequential terms. Taking these figures into consideration, we maintain our belief that the surge in the stock's value is not attributed to its underlying performance, but rather influenced by market speculation. As a result, we anticipate that the stock will relinquish its gains in the latter half of 2023. The earnings for Tesla in the first quarter of 2023 are illustrated in the chart below.

Tesla's Financial Performance for the First Quarter of 2023

Focus On China's Market

Tesla is well-positioned to take advantage of the increasing popularity of electric vehicles (EVs) and government regulations that support the transition away from traditional gasoline-powered cars. The EV market is expected to experience significant growth, with revenues projected to increase at a compound annual growth rate of 10.07% between 2023 and 2028. This presents both opportunities and challenges for Tesla, as more demand for EVs means more potential customers but also increased competition. One of the biggest rivals for Tesla in the Chinese market, which is currently the largest market for EVs, is the BYD Company. Other competitors include NIO, Li Auto, XPeng, and various other EV startups. This is significant for Tesla because the company earned around 21% of its total revenue from China in the first quarter of 2023. With competition intensifying in this crucial market, investors should pay close attention to how Tesla handles the situation.

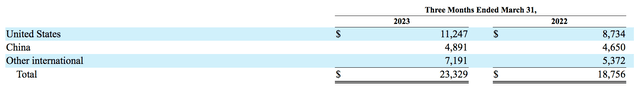

The accompanying graph displays the income generated in different regions, with the values in millions, according to the place of sale.

Musk is also considering India; the company's leadership met with the Prime Minister of India to talk about growth, with India encouraging the automobile industry to make a "substantial investment" in the country." This decision could bring great benefits for Tesla and lower the expenses of car manufacturing, helping to sustain a favorable cash flow. However, we still don't believe it will save the company's stock from challenges in the near future in the second half of 2023.

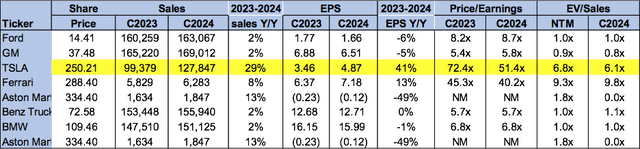

The stock of Tesla is priced too high and trading at a unfairly high multiple. When looking at the company's earnings per share in 2024, the stock is trading at a multiple of 51.4 times, compared to the average of other similar companies at 19.7 times. Additionally, when looking at the company's sales in 2024, the stock is trading at a multiple of 6.1 times its enterprise value, compared to the average of other similar companies at 3.3 times. We believe that Tesla's growth potential is not being accurately considered in its valuation, especially considering the challenges of the current economic climate and the pressure on Tesla's profit margins. The market is giving Tesla too much credit for its long-term prospects. We recommend that investors sell their Tesla stock at its current price and reconsider investing in it later in the year, once the challenges of the macroeconomic environment have been taken into account.

The chart provided depicts the comparison of Tesla's worth with that of its counterparts.

The Buzz On Wall Street

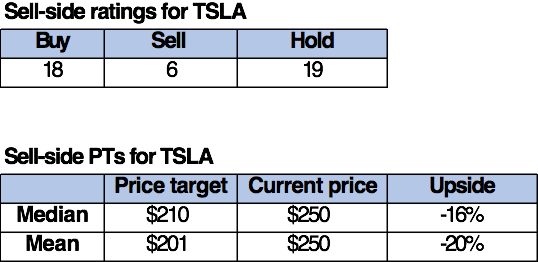

It's quite unexpected that Wall Street has a negative outlook on the stock. Out of the 43 analysts who cover the stock, 18 recommend buying, 19 recommend holding, and the rest advise selling. Recently, there has been a noticeable change in analyst sentiment towards Tesla, with Goldman Sachs Group (GS) being the fourth to join the pessimistic side as Mark Delaney downgraded his recommendation from buying to neutral. This shift in market sentiment towards Tesla reaffirms our belief that the company will face challenges in the second half of 2023.

The shares are valued at $250 each. The average target price for selling the shares is $210, while the overall average is $201, indicating a potential decrease of 16-20%.

The subsequent graphs illustrate Tesla's ratings from analysts in the selling market and their predetermined price objectives.

How To Handle Stocks

We maintain our negative outlook on Tesla, Inc. shares - while we remain optimistic about Tesla's future prospects, we foresee a decline in the second half of 2023 and suggest that investors consider cashing in their profits at current levels and investigate options for selling their shares. We acknowledge that we were premature in our previous recommendation to sell, but we still anticipate a decrease in the stock price due to underlying problems impacting profit margins, increased competition, and economic factors affecting consumer demand. Additionally, we anticipate potential scarcity of lithium in the future as the electric vehicle market expands, owing to delays in obtaining mining permits, a shortage of labor, and rising inflation. Therefore, we advise investors to take advantage of the year-to-date surge in Tesla's stock and evaluate suitable opportunities to sell their holdings.

Author's Note: This piece focuses on one or more financial assets that are not listed on a prominent American market. Kindly familiarize yourself with the potential hazards linked to investing in these shares.

Thank you for your curiosity in our technology articles. If you desire direct entry to our examination of software/hardware and semiconductor industries, top suggestions given the current economic situation, and our esteemed research method, we encourage you to try Tech Contrarians, our Investing Group service, for a 2-week trial period free of charge. The initial group of subscribers will receive a noteworthy perpetual reduction on yearly subscriptions following the trial, so we look forward to your presence in our community in the near future.

![Tesla Announces Ability to Transfer FSD; Must Take Delivery in Q3 [Full List of Requirements]](/_largethumb/uploads/news/104/10491/0/10491026-tesla-announces-ability-to-transfer-fsd-must-take-delivery-in-q3-full-list-of.jpg.webp)

![Tesla Announces Ability to Transfer FSD; Must Take Delivery in Q3 [Full List of Requirements]](/_newsthumb/uploads/news/104/10491/0/10491026-tesla-announces-ability-to-transfer-fsd-must-take-delivery-in-q3-full-list-of.jpg.webp)