Tesla (TSLA): Clearly Too Expensive Again (Rating Downgrade)

In my previous blog posts published in early 2023, I analyzed Tesla, Inc. (NASDAQ:TSLA) and pointed out the possibility of its share price reaching $200 or more. Both articles labeled the stock as a Hold, which was in line with my previous prediction that its value could drop to $100. It seems that growth investors on Wall Street have once again succumbed to inflated thinking, causing not only artificial intelligence (AI) stocks to rise significantly, but also lifting the share prices of previous Big Tech winners.

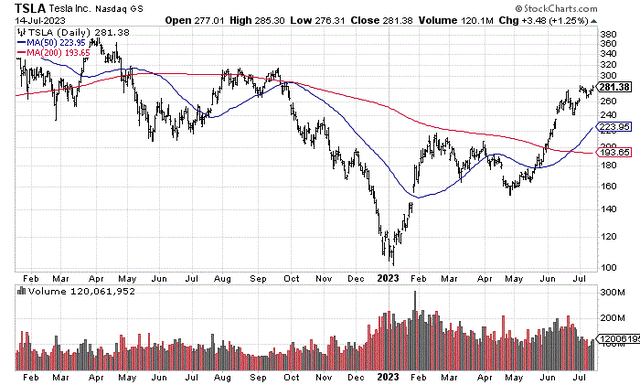

StockCharts.com's section titled "Tesla, 18 Months of Daily Price & Volume Changes" delves into the fluctuations in Tesla's daily prices and trading volume over a period of 18 months.

In my previous blog post in April, I discussed how the high likelihood of a downturn in the economy in the latter half of the year would have a limiting effect on Tesla's performance and its stock value. However, recent economic indicators in the United States have surpassed expectations and contradicted predictions of a slowdown. It's not difficult to see why Tesla has regained a sense of optimism. The idea that there will be a gradual decrease in demand for cars and houses, keeping their sales at a high level, is the main reason for this renewed enthusiasm.

(Note: If you want a clear indication that the Federal Reserve's attempt to reduce excessive speculation on Wall Street has been a complete failure, the significant increase in the price of the NASDAQ 100-Index (NDX) throughout 2023 is indisputable proof that further measures need to be taken to tighten policies, otherwise, we run the risk of another significant increase in inflation. Considering the ongoing rise in housing prices and the strong recovery of the U.S. stock market recently, it seems unlikely that inflation rates will drop below 3% in the next year.)

Alright, let's dive in once more. I am shifting my classification of Tesla's rating to Sell due to inflated valuations and an excess of enthusiasm from investors. There is a substantial chance of a decline in stock prices, and any potential gains can only be expected if the speculative frenzy on Wall Street keeps escalating. Moving forward into the remaining months of 2023, there is the looming possibility of a significant increase in the risk of a price "crash" if today's overextended valuation continues to rise.

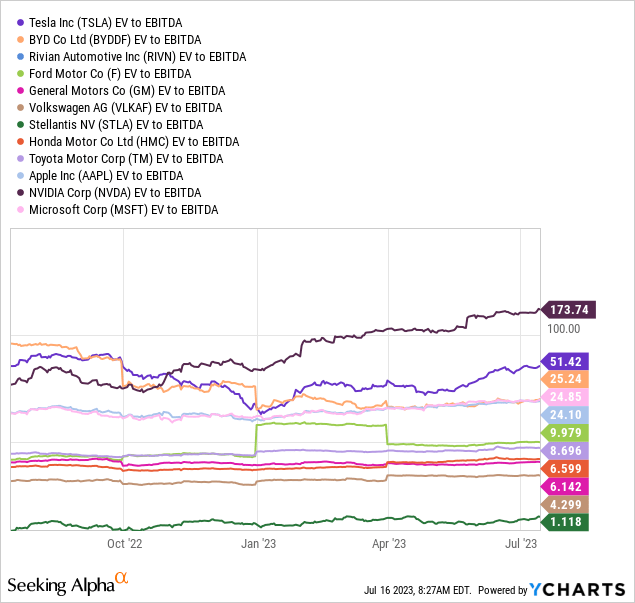

Not just has Tesla's market worth surged back to a level that surpasses the collective value of all other car manufacturers, but basic data based on price or enterprise value to operational outcomes are strongly advising investors to be cautious. Even if one considers Tesla's other endeavors to categorize it as a major player in the Big Tech field rather than a mere car company (which I personally disagree with), the valuation scenario seems excessively inflated once more.

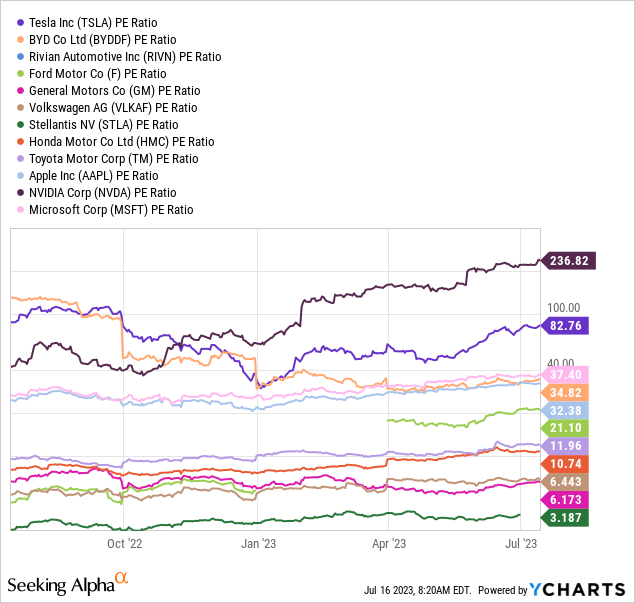

Tesla is undoubtedly the priciest vehicle manufacturer for investors. Moreover, among all the major technology companies in the United States, only Nvidia Corporation (NVDA), known for its obsession with artificial intelligence, has a higher market value due to hopes and aspirations of economic growth.

When we examine the main tool used in the investment world to determine value, which is the ratio of price to trailing earnings, Tesla and Nvidia stand out compared to other companies in the same industry. This group also includes electric vehicle manufacturers BYD Company and Rivian Automotive, as well as major automakers Ford, General Motors, Volkswagen, Stellantis, Honda, and Toyota. Additionally, it includes tech giants Apple and Microsoft. Tesla's ratio of 83x indicates an earnings yield of 1.2%, which is significantly lower than the current inflation rate of over 3%. Moreover, it's important to take into account the likelihood of inflation rebounding in the near future.

Comparison of Tesla with Automotive and Technology Giants Based on Trailing Earnings over the Past Year

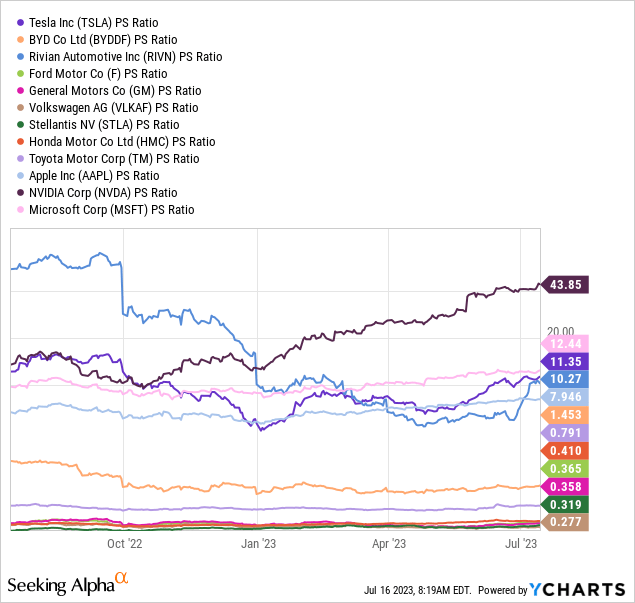

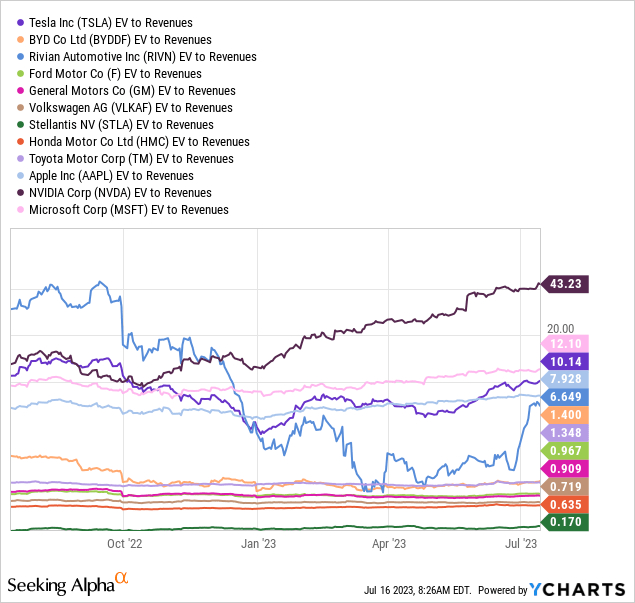

The price to sales ratio at Tesla has gotten better in the past year, but it still ranks among the highest compared to its peers at 11 times. It's important to mention that companies with rapid growth and minimal debts usually have a sales ratio of more than 10 times. This brings up an important question for Tesla shareholders: Does this valuation still make sense considering the slower growth and rising competition?

Comparison of Tesla's Price to Trailing Sales with Other Auto and Big Tech Competitors in the Span of 12 Months by YCharts

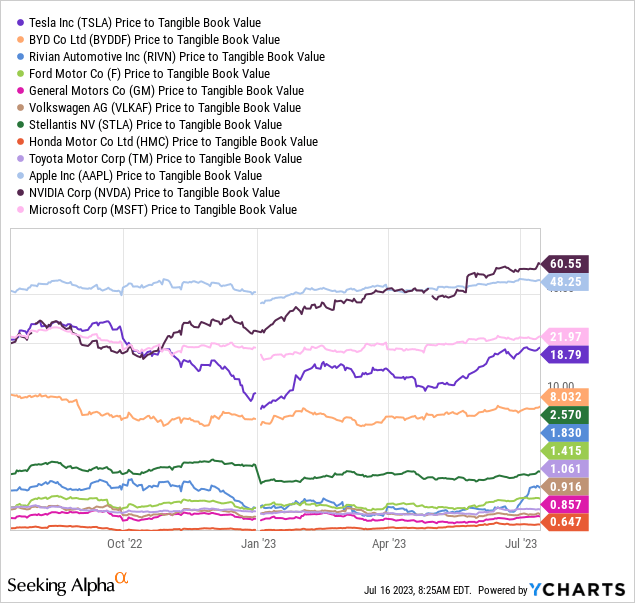

Another excessively high valuation measure is the ratio of price to tangible book value. By considering all tangible assets such as cash, outstanding payments, inventory, and tangible fixed assets like machinery, and then deducting all obligations and liabilities, the net value of tangible assets is quite distant from the current share price of $281. With a ratio of nearly 19 times the underlying net tangible assets, this figure is significantly greater than the average ratio of the rest of the automobile industry, which stands at just under 1.5 times.

Comparing Tesla with other auto and big tech companies in terms of tangible book value over the past year on YCharts.

Furthermore, taking into consideration the liabilities and factoring in the amount of cash available, the overall value of the business appears even more inflated from an investor's perspective. The ratio of enterprise value to EBITDA is currently at 51x, which is similar to the level seen a year ago, and significantly higher than the average of 9x among other companies in the same industry.

YCharts - Comparing Tesla to Other Auto and Big Tech Companies based on Enterprise Value to Trailing EBITDA over the past year.

Tesla's EV to revenues ratio of 10x surpasses the typical automaker benchmark, which hovers below 1x. One must ponder whether Tesla truly merits such a high multiple when compared to various companies that may feasibly reach similar EV unit production levels within a mere five years.

Comparison Today, we'll be discussing the comparison between Tesla and its counterparts in the automotive and big tech industries in terms of Enterprise Value to Trailing Revenue over a span of one year.

Growth's Sluggish Pace

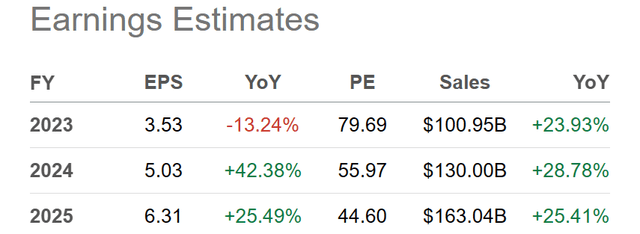

Following the observation of a yearly increase in sales by over 50% from 2019 to 2022, coupled with a more rapid surge in net profit, financial analysts on Wall Street are currently predicting a robust but not extraordinary growth rate of 25% for the company. The reason for this projected decrease is primarily due to the proliferation of competitors in the electric vehicle market and the overall expansion of the industry. Additionally, the growth rate is influenced by the company's significant expansion in size compared to its state in 2018.

Looking for information about Tesla's potential performance? Check out the Seeking Alpha Table, where you can find analyst predictions for the years 2023-2025. This table was compiled on July 15th, 2023.

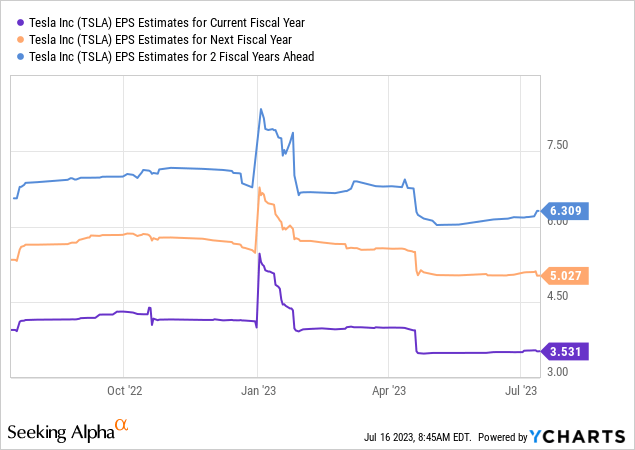

Moreover, the concept that a decrease in prices is hindering the growth of earnings has become the fundamental belief among analysts. Consequently, predictions for earnings per share in the upcoming years have been constantly decreasing since the beginning of 2023, with revised lower projections becoming the regular occurrence. Presently, the anticipation for operating income between 2023 and 2025 is lower than it was a year ago.

YCharts - The latest data on Tesla reveals that analysts have lowered their predictions for the company's future earnings per share (EPS) results from 2023 to 2025. These revised estimates were published on July 15th, 2023.

I still have doubts about owning Tesla because the increasing competition in the market could seriously impact their ability to make profits. There are now hundreds of new electric vehicle models being released by all the major car companies, which will continue until 2026. Even if Tesla maintains its position as the best-selling and most well-known brand in the industry, the slowing growth in profits will discourage investors who see the company as overvalued at its current high price.

Another concern is the potential decline in car sales, including those for Tesla vehicles, in case of a recession. This would be particularly exacerbated if there is a prolonged period of sluggish economic growth globally. China, which holds the second position in terms of its impact on company sales and production after the US, has not experienced the strong growth that many experts anticipated after reopening from COVID-19 related shutdowns. In fact, the centrally planned economy of China is already witnessing the government's attempt to stimulate the economy by implementing looser financial policies and boosting overall demand.

I am aware that there are people who strongly support Tesla and think that the company can overcome any obstacles, regardless of its stock value, competitors, or economic situation. However, I am convinced that Tesla is similar to any other business and will eventually have to face the truth, including the financial aspect of being an investment. Its previous achievements were driven by an incredibly high sales growth, thanks to its dominant position in the global electric vehicle market. It is important to acknowledge that Tesla has never experienced a recession before (it can be argued whether the 2020 pandemic was a typical economic downturn), where consumer demand for cars declines for all companies in the industry.

It is quite likely that the predicted sales and EPS figures will exceed expectations amidst a recession and increasing competition. In such a scenario, the overvalued state in July 2023 could be even more extreme than we currently comprehend.

Purchasing Tesla stocks at $281 in July is an incredibly risky decision. When looking at potential drawbacks, I believe that Tesla's stock will drop below $200 later this year, and potentially reach as low as $150 by 2024. However, when considering the Consumer Price Index (CPI) of 3%, as well as the projected growth rates of EPS and sales at 25% from today, it seems reasonable to consider buying shares when the trailing P/E ratio is closer to 50x and the 2-year forecast is around 30x. These numbers are based on solid mathematical calculations and provide a logical justification for investing in Tesla.

In simpler terms, another increase in inflation and interest rates would negatively impact the value of growth stocks, similar to what happened in 2022. Furthermore, the likelihood of a recession next year would greatly increase, which would be terrible for those who have invested in Tesla. It's important to be cautious about what you desire, as my unconventional reasoning suggests that selling Tesla is a wise choice in order to avoid the negative effects of a global economic downturn.

I believe that going against the mainstream and selling the stock when it is performing strongly is the most sensible decision, as the future might not be as positive as expected. Those who are blindly following the upward trend in the stock's price might be deceived into thinking that everything is going perfectly well with Tesla and its prospects, precisely when it is the worst time to do so.

The positive aspect of purchasing Tesla stock is now essentially the trendy notion among investors this year. It relies on the belief that more and more buyers will drive up the price and value of the stock, without considering any rational analysis of its worth. While this trend may persist for a couple more months, eventually it will come to an end, even for Elon Musk and the excessively concentrated tech industry on Wall Street by 2023.

Thank you for taking the time to read this. Please regard this article as an initial phase in conducting thorough research. It is highly advisable to seek guidance from a licensed and knowledgeable investment consultant before engaging in any trading activities.

Please note: This blog post talks about one or more stocks that are not listed on a major U.S. stock exchange. It is important to consider the risks involved with investing in these securities.

This blog post was authored by

Paul Franke is an experienced investor and speculator with 36 years of trading experience. He has been recognized nationally for his stock market and commodity macro views and has been ranked among the top investment advisors. Mr. Franke has also participated in stock picking contests and has achieved impressive results, ranking #1 in one contest out of over 60,000 portfolios. He has worked as a Director of Research and has run various model portfolios. Currently, he is ranked in the Top 5% of bloggers for his stock picking performance. Mr. Franke's stock picking style is contrarian, and he uses a system called the "Victory Formation" to find stocks. This system incorporates daily analysis of fundamental and technical data, with a focus on supply/demand imbalances indicated by specific stock price and volume movements. To maximize success, Mr. Franke recommends using stop-loss levels of 10% or 20% on individual choices and diversifying by owning at least 50 well-positioned stocks. He also employs short selling as a strategy to profit from overvalued and weak momentum stocks. In addition to the Victory Formation, Mr. Franke also discusses "Bottom Fishing Club" articles, which highlight deep-value candidates or stocks with a significant reversal in technical momentum. He also writes "Volume Breakout Report" articles, which analyze positive trend changes supported by strong price and volume trading activity.

Disclosure by Analyst: I do not possess any stocks, options, or similar financial instruments in the companies discussed and have no intentions of taking such positions in the next 72 hours. This article is solely my own creation and it reflects my personal viewpoints. I am not receiving any payment for it (excluding compensation from Seeking Alpha). Furthermore, I do not have any affiliations with any company mentioned in this article that may impact their stock.

This piece is intended for educational and informative purposes only. The opinions expressed here are not recommendations for investment and should not be relied upon when making investment decisions. The author is not acting as an investment advisor and is not registered as one. It is recommended that investors consult with a qualified investment advisor before making any trades. Any predictions, market forecasts, or estimates mentioned here are based on assumptions and should not be seen as guarantees of actual events. This article is not a research report, but rather an opinion expressed at a specific point in time. The author's opinions here are only based on a small amount of data related to the securities being discussed. The information and data in this article is obtained from sources believed to be reliable, but its accuracy and completeness cannot be guaranteed. The author takes no responsibility for any errors or omissions in the content and disclaims liability for the use or interpretation of the information by others. All opinions, estimates, and conclusions expressed here are based on the author's best judgment at the time of publication and may change without notice. The author has no obligation to correct, update, or revise the information in this document or provide additional materials. Previous performance does not guarantee future returns.

Seeking Alpha's Disclaimer: Previous achievements do not ensure future outcomes. We are not providing any suggestions or guidance on the suitability of any investment for a specific individual. The perspectives shared above might not represent the entirety of Seeking Alpha's viewpoint. Seeking Alpha is not authorized to trade securities, act as a broker or US investment advisor, or function as an investment bank. Our analysts are independent authors, comprising both professional and individual investors who may not hold licenses or certifications from any authoritative organization.

![Tesla Announces Ability to Transfer FSD; Must Take Delivery in Q3 [Full List of Requirements]](/_largethumb/uploads/news/104/10491/0/10491026-tesla-announces-ability-to-transfer-fsd-must-take-delivery-in-q3-full-list-of.jpg.webp)

![Tesla Announces Ability to Transfer FSD; Must Take Delivery in Q3 [Full List of Requirements]](/_newsthumb/uploads/news/104/10491/0/10491026-tesla-announces-ability-to-transfer-fsd-must-take-delivery-in-q3-full-list-of.jpg.webp)